How it works «Cashflow forecast» #

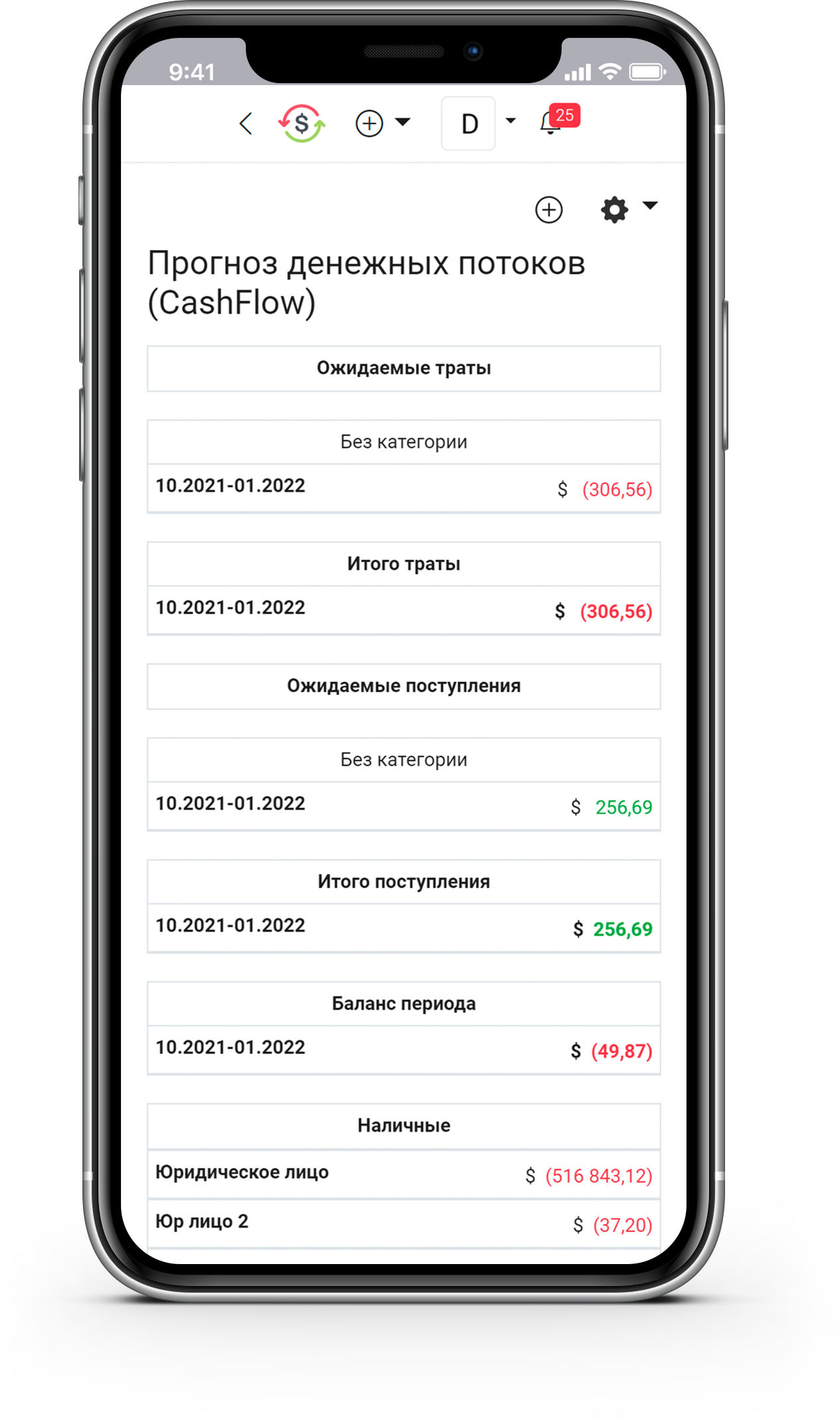

The app shows your cashflow in future, based on the expected payments.

- install the application;

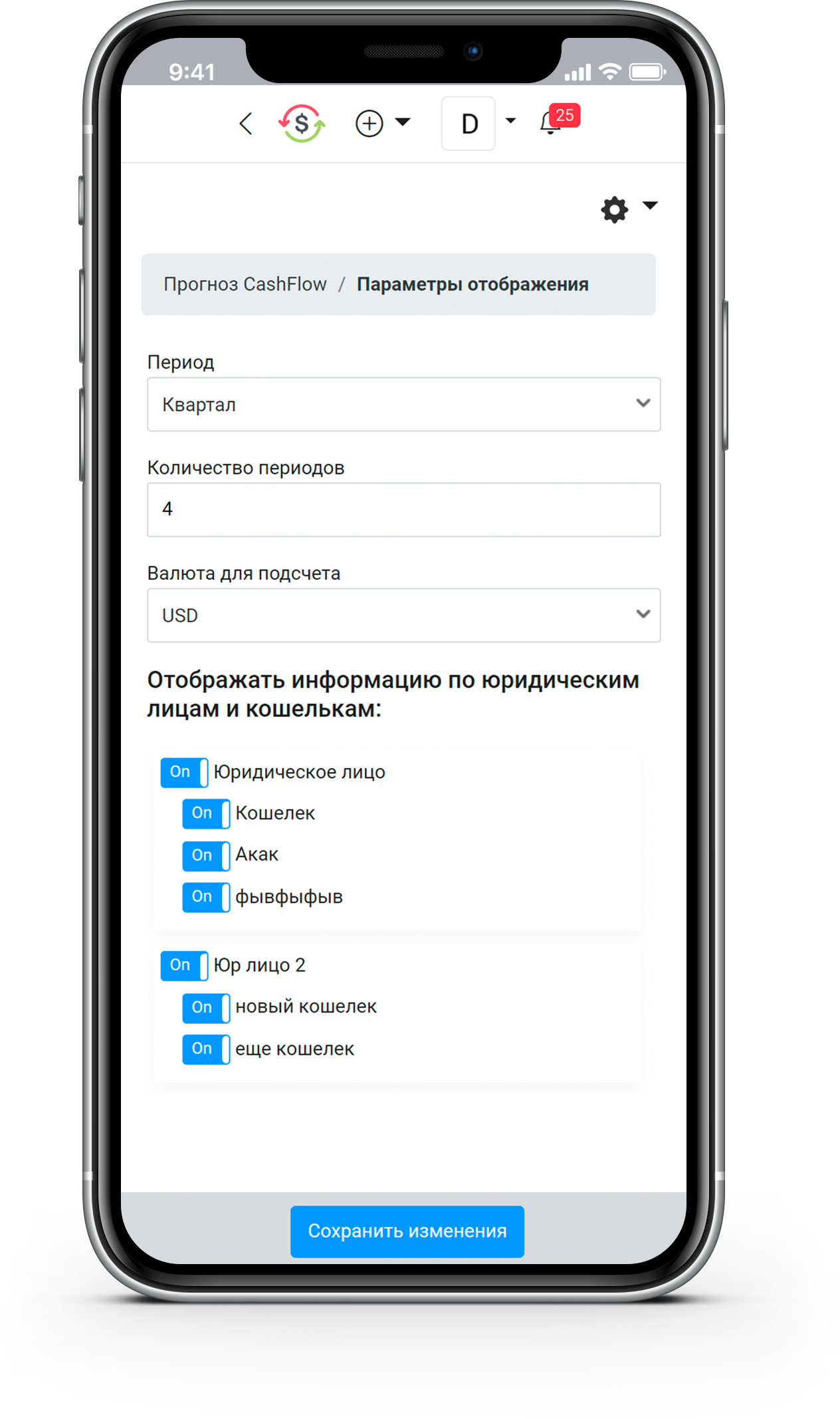

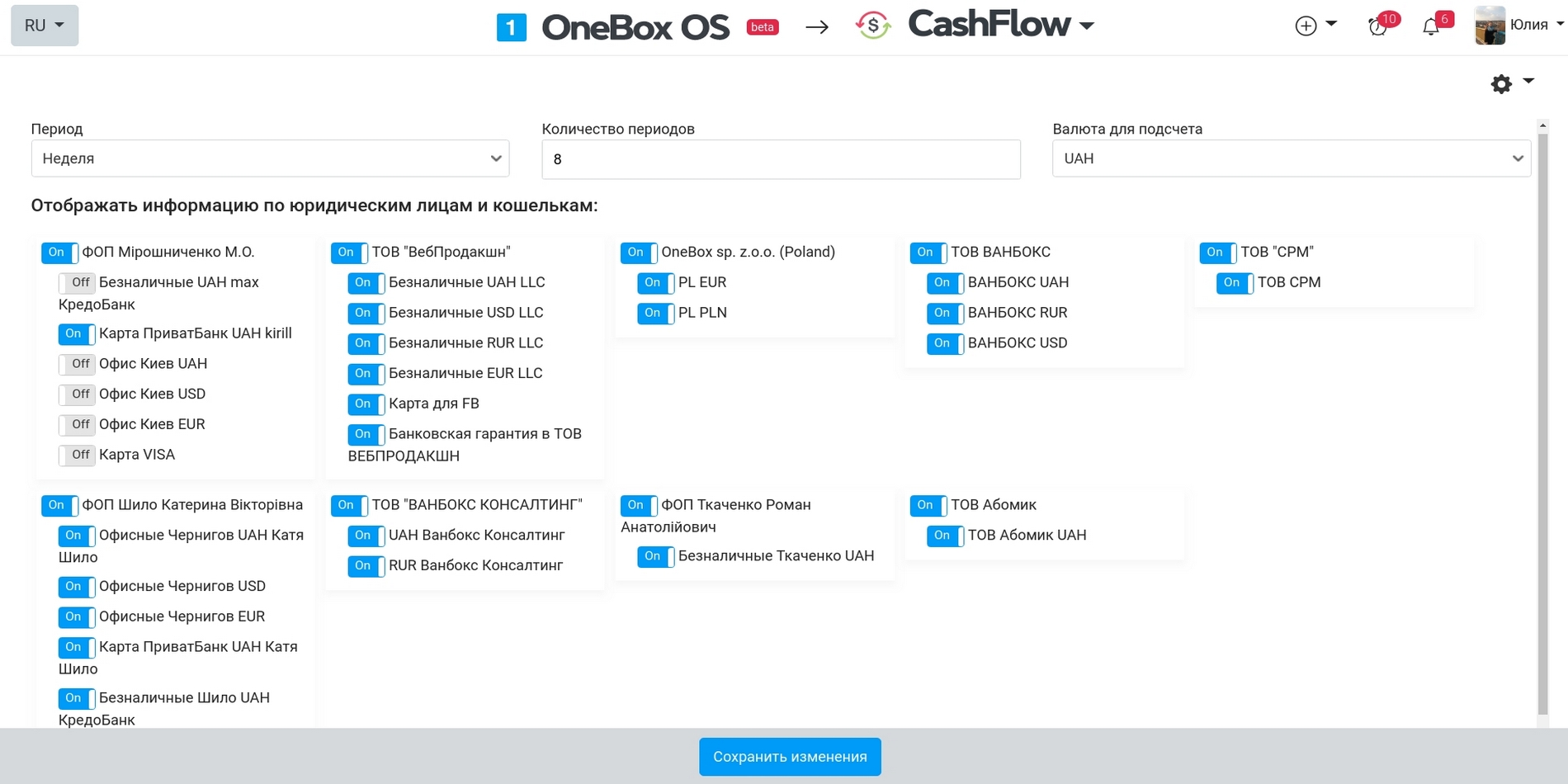

- set the currency to convert all the payments to in the app settings;

- set the period you'd like to check the Cashflow for: for example, 10 weeks ahead;

- specify the legal entities and accounts, you want to use as sources for report.

The app will show your company's balance as of each upcoming period. The calculation is based on your actual balance (the amount you currently have on your account) and all the expected payments from the current date in future.

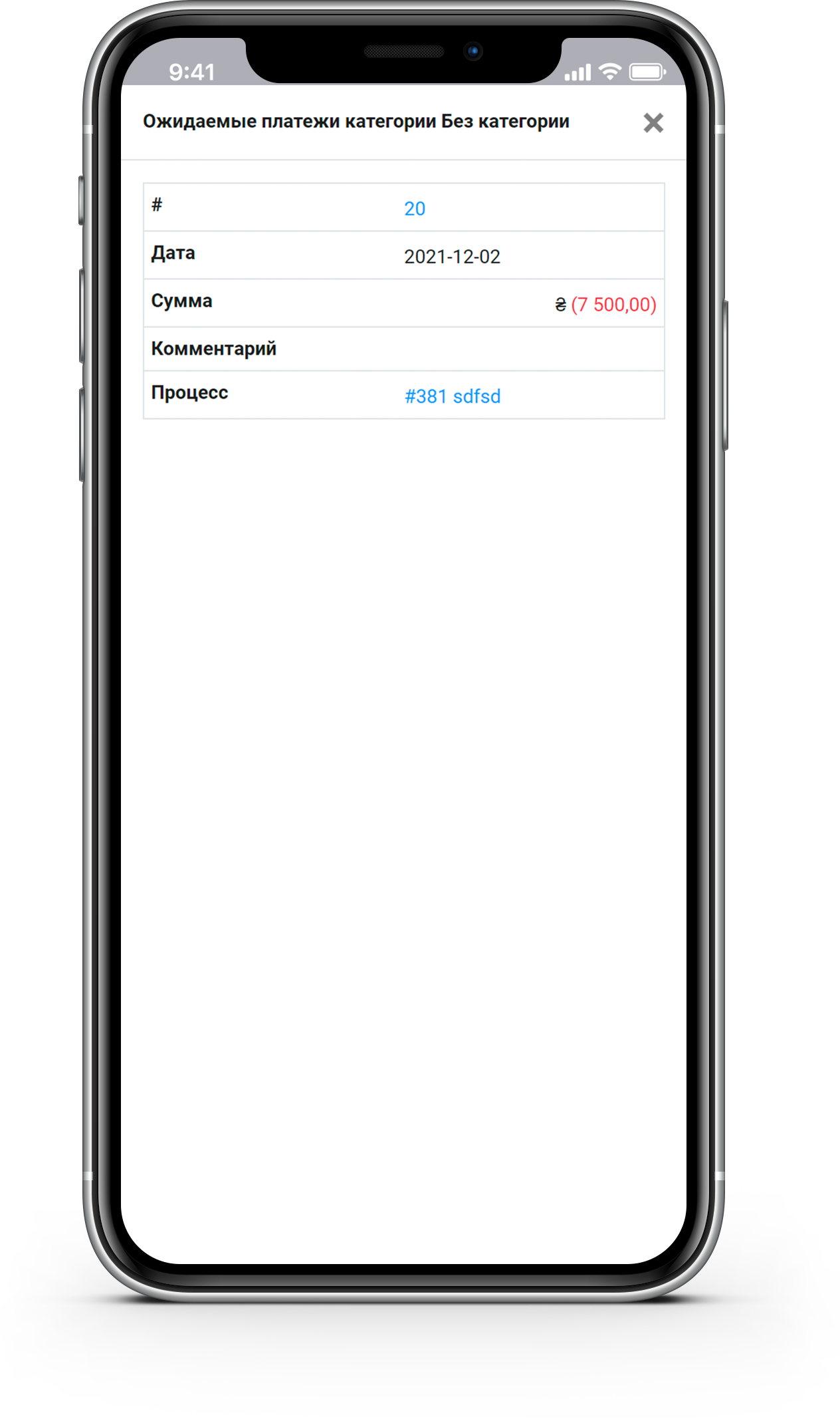

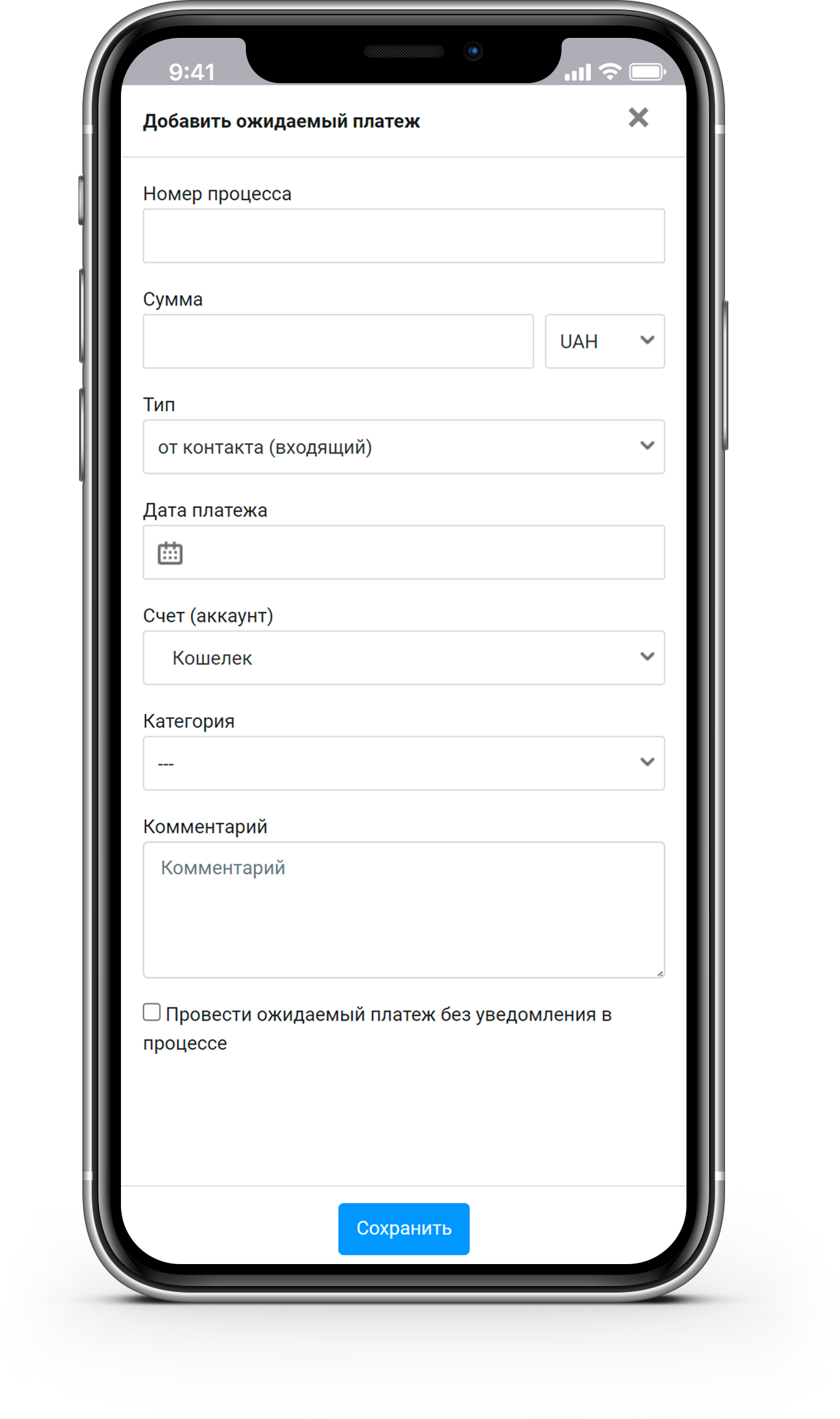

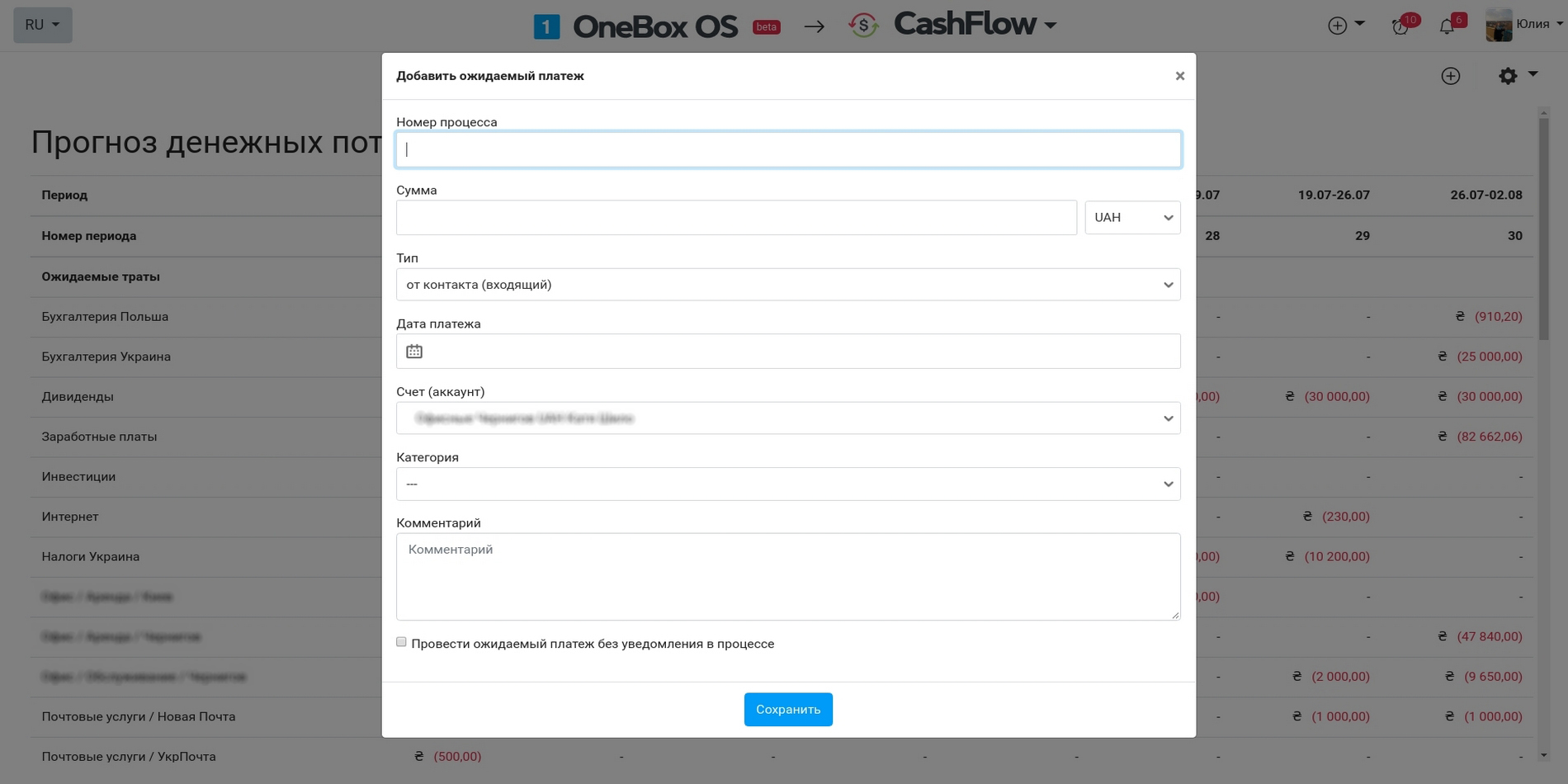

The app doesn't do any divinations. You need to fill out the expected payments (using either Cashflow or Expected payments app), so the calculations work correctly.

If you need some kind of automation or prediction, it is doable, but on an individual basis. You can address a request to the partners-integrators to setup the logics of automatic creation of expected payments for you and Cashflow will work easier and more accurately.

Cashflow Forecast app reflects the future cashflow, based on your expected payments. In such a way it allows your business to avoid the cash gaps and other nuisances, since you will know about them long before they possibly happen. All you need to do is to add processed and cash transactions and the app for finance accounting Cashflow will show you, when and how much money would be enlisted on the company's account.

This service ensures accurate financial accounting for small to medium business. You can structure all expenses and income, and also predict the financial future of the company in a given period of time, based on real numbers.

Wide range of functions and full control of company's finances

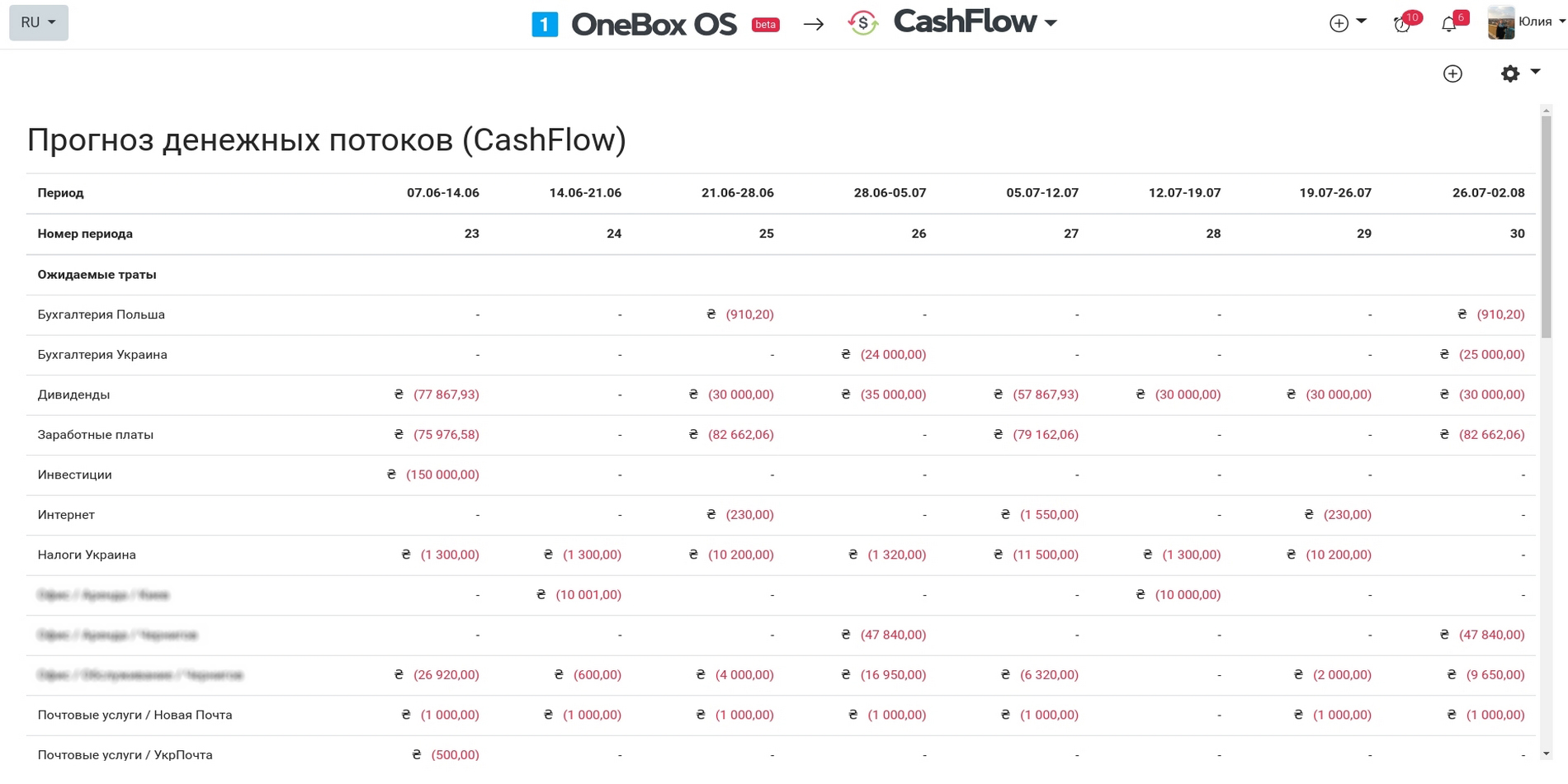

Cashflow Forecast app for financial accounting has easy interface and fits any industry. Its functionality provides for display of the following information:

- billing periods (day, week, month or quarter);

- expected company's expenses - by specific objects of expenditure and in general;

- balances;

- expected income to the account;

- cash amount etc.

You can add new objects of expenditure or planned income right into the report at any time and you'll instantly get company's budget calculation. You can set the required currency for the calculations.

Cashflow Forecast is a perfect tool for planning company's budget

Our program for accounting of company's income and expenses allows to plan your budget accurately, based on the real data of your expected payments. You will know exactly, when and what amount of expenses is planned for a certain purpose.

Benefits of the cashflow accounting app Cashflow:

- Precise forecast of movement of company's funds, since it is based on real numbers.

- It will take less than 5 minutes to enter the figures of planned expenses and expected payments.

- Detailed report for a chosen period will show you all the company's cash flows.

- The ability of selective configuration to adapt the app to specifics of your business's field of activity with the exact objects of expenditure specified.

- Its functionality provides for cash accounting in any currency - hryvnas, rubles, dollars or euro.

- Details about your company's cashflows are always at your fingertips, since the service is available in the cloud and on your smartphone (available for iOS and Android).

Cashflow app will give you a clear understanding of direction your business is moving to! It's a perfect tool for planning company's budget, based on a real data.

Cloud pricing for data and applications

Cloud pricing per user

Boxed solution (on-site)

Available Platforms «Cashflow forecast» #