How it works «Budgeting» #

The app is adding "Budget" entity - and you can now assign all the payments to the virtual budgets.

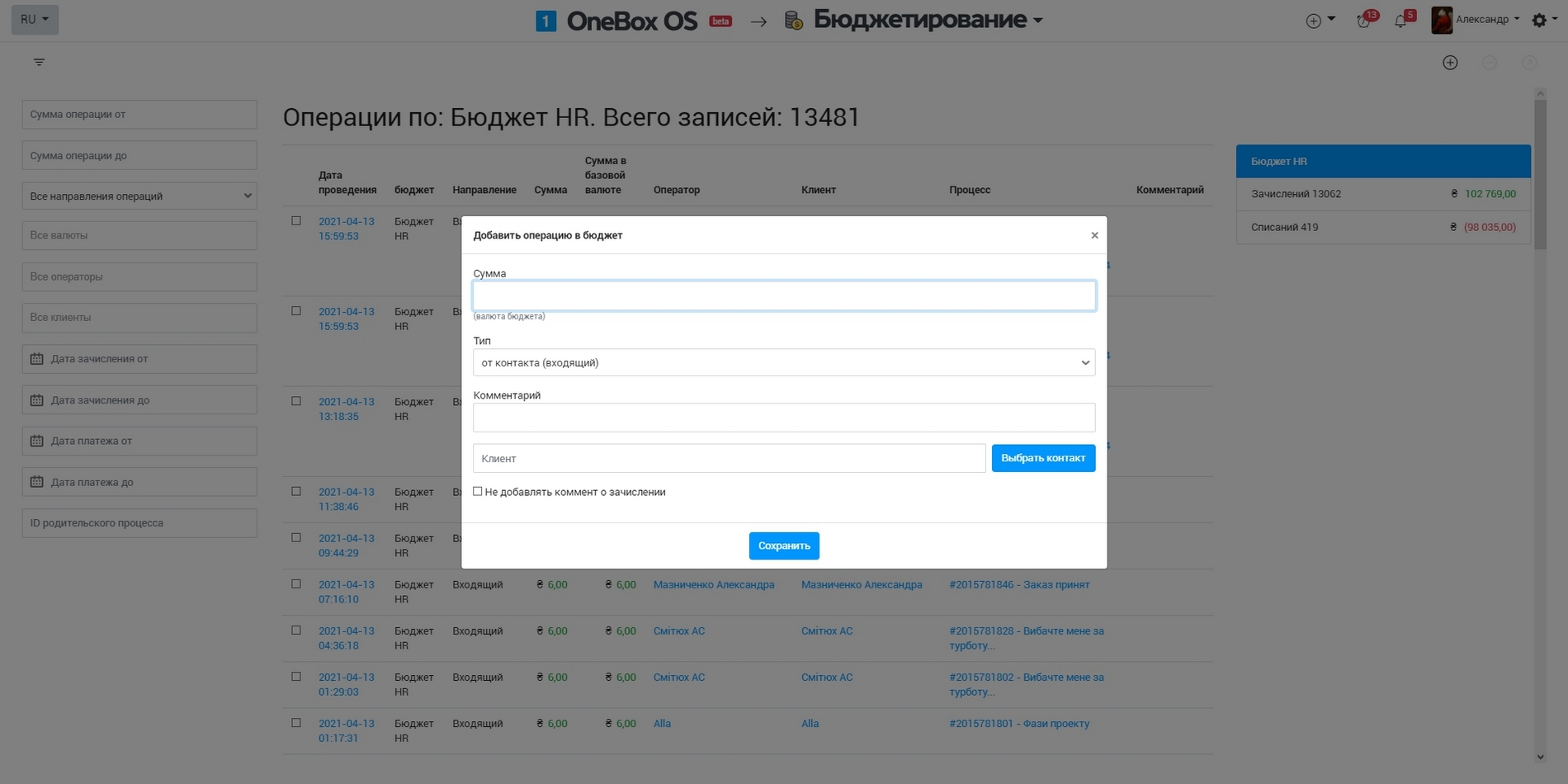

If you have this app installed, an additional window "Enroll to budget" (for incoming payments) or "Charge off the budget" (for outgoing payments) will appear, when running the regular payment (Payments and cashbox app).

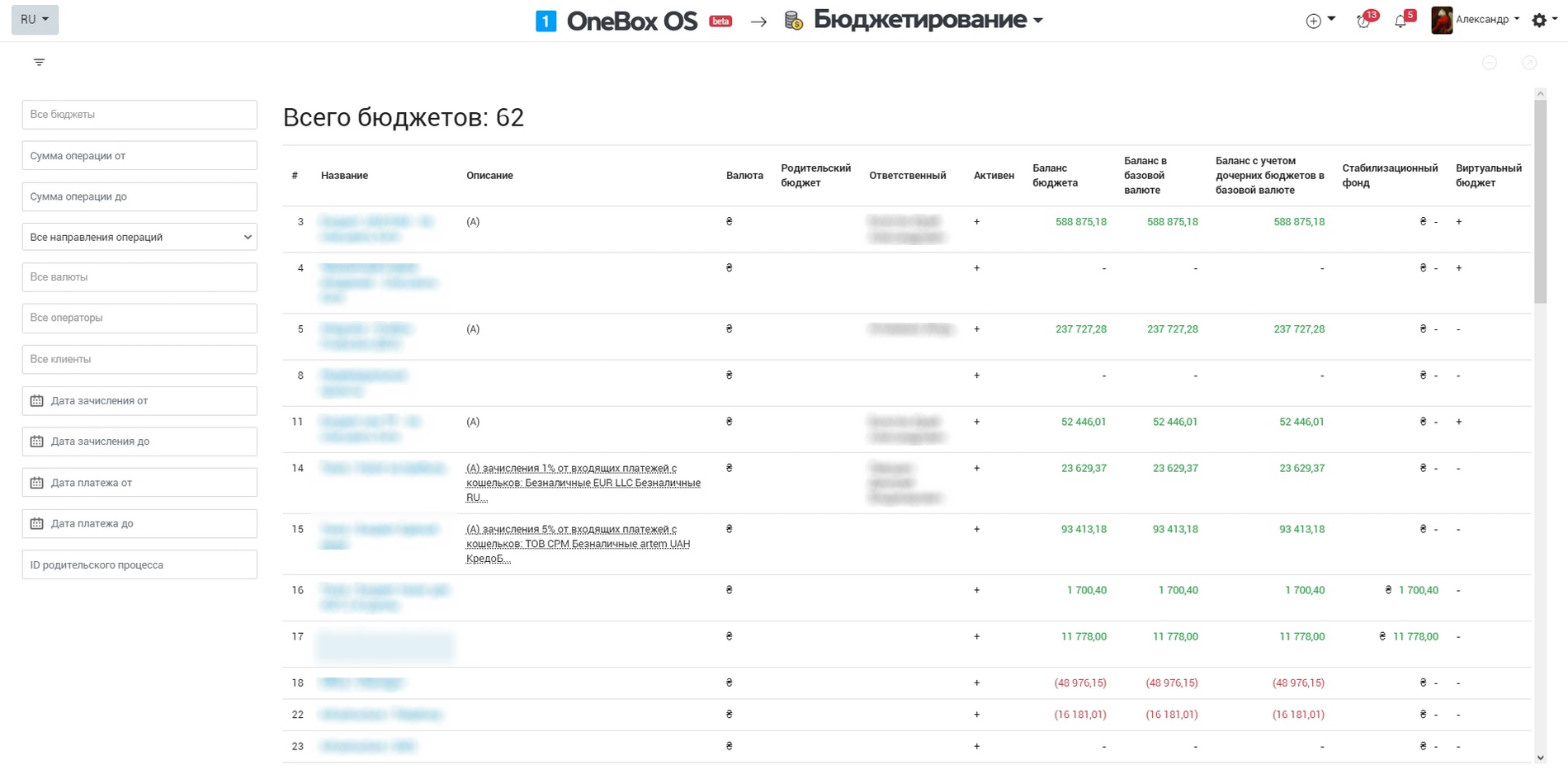

You can create any number of budgets and configure automation of funds allocation, if required.

A typical example of using budgets in OneBox:

- a client paid 1000 USD for the product;

- 80% of this money go to "Provider AAA" budget;

- 10% of this money go to "Sales" budget;

- 10% of this money go to "Taxes" budget.

The payment is submitted to provider AAA after a while:

- an actual payment is conducted (in Payments and cashbox app);

- a required amount is charged off the "Provider AAA" budget.

One of the reason, why the budgets are essential, is that some kind of virtual "barrels" are created to keep track of commitments to a group of peolpe: how much do you owe to managers, suppliers, tax office etc. With this approach you can compare the amount of budgets with the balances of all cashboxes and figure out if you have enough money to cover the commitments or not. Positive balance means profit, negative means shortage.

There's also "Mutual settlement" application in OneBox OS, which allows to control the detailed commitments between you and contractors, based on accounting similar to 1C.

Budgeting – application for accounting of company finances, which is suitable for any area of business where payment transactions are involved. Differs in wide functionality, easily configurable and reprogrammed for the specifics of a particular type of activity.

Budgeting delineates business finance between individual departments. For example, if the company has a sales, logistics and technical support department. The functionality of the application allows you to create your own budget for each department, at any time to see its status, enrollments, expenses, refunds, etc.

Budgeting app to help clean up your company's finances

The application for accounting finance "Budgeting" will allow:

- Effectively manage finances, control incoming and outgoing payments, keep key indicators at hand, and avoid a cash gap.

- Keep track of the company's income and expenses. The application for accounting finance divides cash payments according to the specified items of the movement of funds.

- Debt control. For each client, the balance, the history of settlements is displayed.

- Eliminate errors in reporting. Using a budgeting application, you can get a financial report for the selected period in a couple of clicks.

In the application, it is easy to set up the automatic distribution of funds according to specified items and not to do it manually (for example, taxes, payments to the supplier, etc.).

Budgeting app features

Budgeting allows you to carry out almost all financial transactions in any business area.

Tracking key financial indicators

In the application for managing the company's budget, you can at any time view outgoing and incoming payments, profit for the selected period and the total amount of cash on hand, average sales receipts, etc. Any financial indicator will be at your fingertips.

It is possible to set up a system for automatically tracking the balance of wallets, expected and unreceived payments.

Settlements with suppliers and customers

Monitor financial transactions with suppliers using the Budgeting application to see debts, information on credits to the company account, and more.

Payments and checkout

Enterprise budgeting using the app will allow you to:

- create the required number of cash desks for non-cash and cash payments;

- fix the return of the goods;

- pay bills from suppliers;

- accept payment for the goods / services provided.

Reporting

Financial accounting application Budgeting analyzes financial information and, based on all data, prepares reports on various payment transactions. You will be aware of how much money is in the cash register at the moment, see the number of sales, profits, expenses for employees' salaries, taxes, etc. You can create any report in a few minutes.

Benefits of a company budget app:

- Access from any device. You can install Budgeting on your smartphone, your own server, in the cloud. Choose the most convenient option for you.

- Versatility. The Budgeting application is suitable for almost any field of activity, it allows you to control the movement of non-cash and cash payments.

- Quick setup. It is enough to download the application for accounting of company finances on the desired device and adapt it to your field of activity.

Maintain financial records with the Budgeting program reliably!

Cloud pricing for data and applications

Cloud pricing per user

Boxed solution (on-site)

Available Platforms «Budgeting» #